Best Paying Jobs in Real Estate Investment Trusts (2025)

- 06 Jan, 2026

In this article

- 1. Why REITs Pay Better Than Most Finance Jobs

- 2. The 10 Best Paying Jobs in REITs (Ranked by Total Compensation)

- 3. How to Break Into REIT Careers (From 3 Different Starting Points)

- 4. Certifications That Actually Boost Your REIT Salary

- 5. Top REITs Hiring Right Now (And What They’re Known For)

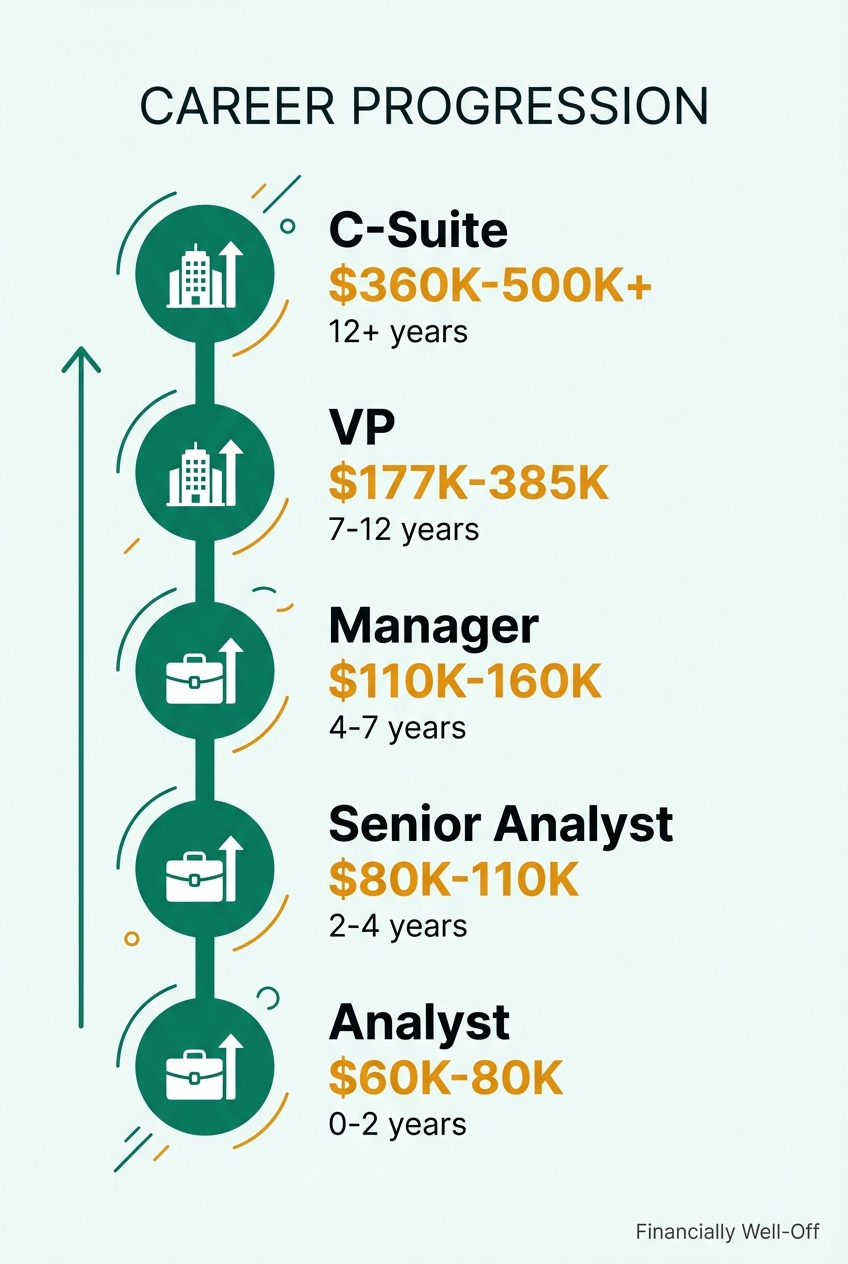

- 6. The Career Ladder: From $60K Analyst to $500K Executive

- 7. Is a REIT Career Actually Worth It?

- 8. Frequently Asked Questions

- 9. Your Career, Your Call

You’re making $75K as a financial analyst, and your VP just said the next promotion won’t happen for 2-3 years. Even then? Maybe $95K.

Meanwhile, you’re reading about Real Estate Investment Trusts. Portfolio managers pulling $160K. VPs making $259K. CFOs clearing $360K in total comp.

You’re thinking: “How do I get in on that?”

Here’s the thing - REIT careers combine finance skills with real estate expertise, and companies managing billions in assets pay accordingly. But breaking in isn’t about luck. It’s about knowing which roles pay what, which certifications matter, and how to position yourself.

I went from negative net worth to $200K+ by focusing on high-income career paths and smart investing. This guide shows you the 10 best-paying REIT jobs, exact salary ranges, and the roadmap to get there - whether you’re coming from finance, real estate, or starting fresh.

Let’s break it down.

Why REITs Pay Better Than Most Finance Jobs

Real Estate Investment Trusts aren’t your typical companies. They own and operate income-producing properties - office buildings, apartments, data centers, warehouses. By law, they must distribute 90% of taxable income as dividends to shareholders.

Here’s why that matters for your salary:

The industry is massive. There are 225+ publicly traded REITs in the U.S. with a combined equity market cap of $1.4 trillion{rel=“nofollow”}. They own over 570,000 properties and support 3.6 million jobs. In 2024, REITs delivered a 14% total return.

When you’re managing billions in assets, compensation reflects that responsibility. A VP of Acquisitions at a major REIT isn’t just buying properties - they’re deploying $100M+ in capital. That’s why the average total comp hits $259K.

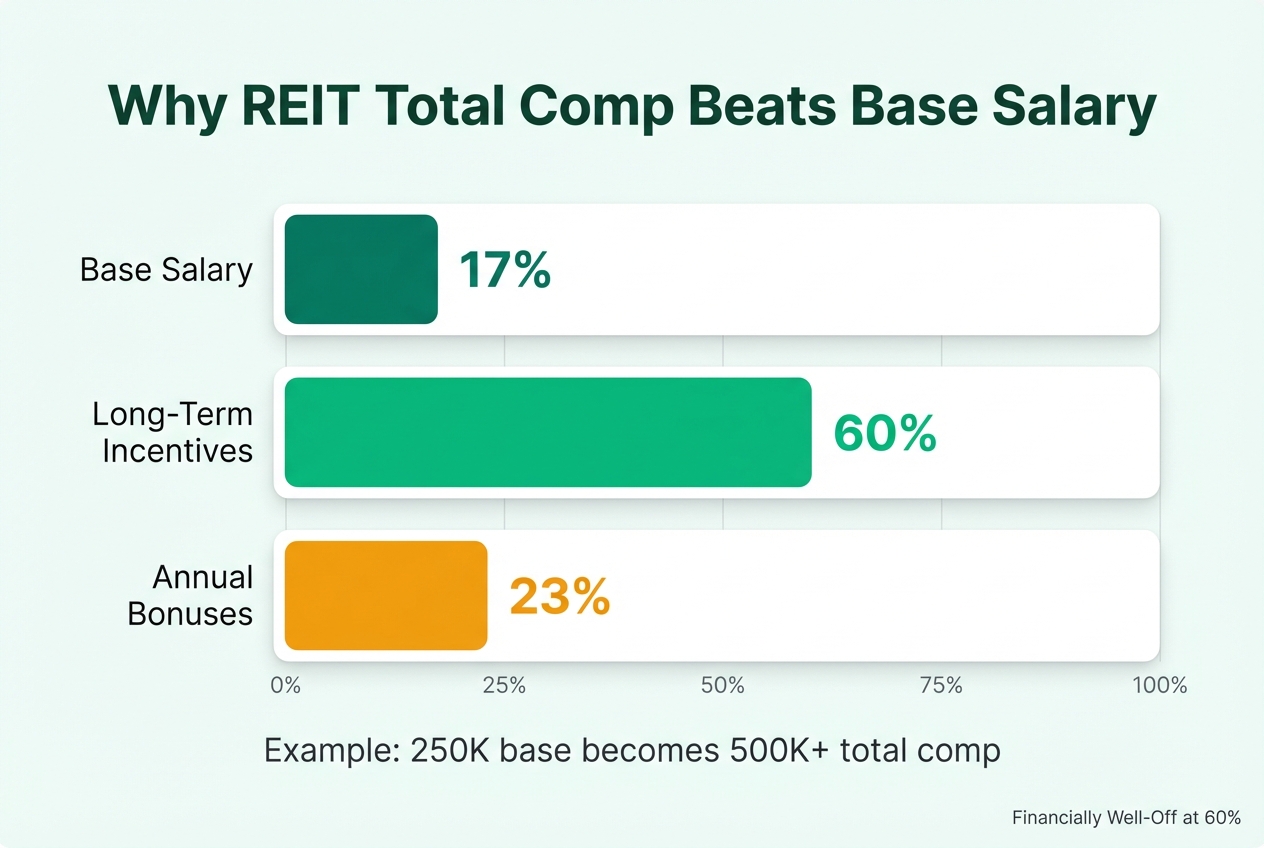

Plus, equity compensation is standard. CEOs get 60% of their total comp from long-term incentives (stock, options, performance units). CFOs, CIOs, and VPs get similar packages. Your wealth grows as the REIT grows.

Bottom line: REITs blend real estate and finance expertise, manage enormous assets, and pay competitively to attract top talent.

If you’re new to REITs as an investment vehicle, here’s how dividend investing works - they’re required to distribute most of their income, which makes them popular with income-focused investors.

The 10 Best Paying Jobs in REITs (Ranked by Total Compensation)

1. CEO / Executive Leadership ($500K+ Total Comp)

This is the top of the food chain. REIT CEOs make serious money - but 83% of it comes from performance-based incentives, not salary.

Compensation breakdown (Morrison & Foerster, 2024):

- Base salary: 17% of total comp

- Long-term incentives (LTI): 60%

- Annual bonuses: 23%

Example: A CEO at a mid-sized REIT might have a $250K base, but total comp pushes past $500K+ with stock grants and performance bonuses. At large REITs (Prologis, American Tower), total comp can exceed $10M+.

What it takes:

- 15-20+ years in real estate/finance

- Track record of successful acquisitions and portfolio growth

- Strong industry relationships

- MBA from a top school helps but isn’t required

The grind: You’re the face of the company. Investor calls, board meetings, strategic decisions. High stress. High reward.

2. Chief Financial Officer (CFO) ($360K Avg Total Comp)

The CFO runs all financial operations - financial reporting, capital allocation, investor relations, compliance.

Salary range (Glassdoor{rel=“nofollow”}, Dec 2025):

- Base: $150K-$300K

- Total comp average: $360K

What they do:

- Oversee financial strategy and reporting

- Manage relationships with lenders and investors

- Ensure REIT compliance (that 90% distribution rule)

- Guide capital markets decisions (debt vs. equity raises)

What it takes:

- CPA or CFA (usually both)

- 10-15 years finance experience

- Prior controller or VP of Finance role

- Understanding of REIT tax structures

The reality: This isn’t a 9-to-5 gig. Quarterly earnings, capital raises, board presentations. But if you like being in the financial engine room of a billion-dollar company, it’s worth it.

3. VP of Acquisitions ($259K Avg, Range $177K-$385K)

This is where the deals happen. VPs of Acquisitions find, evaluate, and close property purchases.

Salary range (Salary.com{rel=“nofollow”}, Oct 2024):

- Average: $259K

- Low: $177K

- High: $385K (with bonuses and equity)

What they do:

- Source acquisition opportunities

- Run financial models (cap rates, IRR, NOI)

- Negotiate purchase agreements

- Coordinate due diligence (inspections, title, environmental)

What it takes:

- 7-10 years in real estate (acquisitions or asset management)

- Strong Excel/Argus modeling skills

- Network of brokers, developers, lenders

- CCIM or CFA helps but isn’t mandatory

The truth: High pressure. Deals fall apart. Markets shift. But when you close a $50M acquisition, the comp reflects it.

4. Chief Investment Officer (CIO) ($250K-$400K+ Total Comp)

The CIO sets the investment strategy for the entire portfolio. They decide which markets to enter, which properties to buy or sell, and how to allocate capital.

Compensation:

- Base: $180K-$250K

- Total comp: $250K-$400K+ (with bonuses and LTI)

What they do:

- Define investment strategy (geography, property types, risk tolerance)

- Oversee acquisitions and dispositions

- Monitor portfolio performance

- Report to the board and investors

What it takes:

- 12-15+ years in real estate investment

- Prior VP or Director of Acquisitions experience

- CFA or advanced real estate degree

- Proven track record of portfolio returns

The challenge: You’re making multi-million dollar calls. Markets change. Interest rates shift. You need to be right more often than you’re wrong.

5. Portfolio Manager ($160K Avg, Range $120K-$217K)

Portfolio managers oversee a segment of the REIT’s properties - could be a geographic region, property type, or specific fund.

Salary range (Glassdoor{rel=“nofollow”}, Dec 2025):

- Average: $160K

- Range: $120K-$217K

What they do:

- Monitor property performance (occupancy, rent growth, NOI)

- Coordinate with asset managers and property managers

- Make hold/sell recommendations

- Track market trends and competition

What it takes:

- 5-8 years in real estate (asset management or acquisitions)

- Strong analytical skills (Excel, Argus, Yardi)

- Understanding of property operations

- Bachelor’s in finance or real estate

The upside: This is a senior role with real responsibility but less stress than VP-level positions. Strong work-life balance compared to acquisitions.

6. Director of Investor Relations ($150K-$250K Total Comp)

REITs are publicly traded. Someone has to communicate with shareholders, analysts, and the media. That’s the Director of Investor Relations.

Compensation:

- Base: $120K-$180K

- Total comp: $150K-$250K (with bonus)

What they do:

- Manage quarterly earnings calls

- Handle investor inquiries

- Coordinate SEC filings (10-Ks, 10-Qs)

- Prepare presentations for conferences and roadshows

What it takes:

- 7-10 years in finance, IR, or corporate communications

- Strong understanding of REIT financial metrics

- Strong public speaking and writing skills

- MBA or CFA helpful

The reality: You’re the bridge between the C-suite and Wall Street. High visibility. Stressful during earnings season. But if you like being the storyteller, it’s rewarding.

7. Asset Manager ($119K Avg, Range $95K-$162K)

Asset managers are the operators. They work with property managers to improve performance - boost occupancy, cut costs, increase rent.

Salary range (Glassdoor{rel=“nofollow”}, Dec 2025):

- Average: $119K

- Range: $95K-$162K

What they do:

- Oversee day-to-day property operations

- Review budgets and financial reports

- Identify value-add opportunities (renovations, lease-ups)

- Coordinate with leasing teams

What it takes:

- 4-7 years in property management or real estate

- Bachelor’s in finance, real estate, or business

- Strong understanding of property operations

- CPM certification is a plus

Why it’s great: This is a mid-level role with solid pay and room to grow. You’re not in the trenches, but you’re not yet at the VP stress level.

8. Senior Financial Analyst ($85K-$115K)

This is the backbone of the finance team. Senior analysts build models, prepare reports, and support acquisitions and portfolio decisions.

Salary range:

- $85K-$115K (base, depending on location and REIT size)

What they do:

- Build financial models (DCF, IRR, cap rate analysis)

- Prepare quarterly reporting packages

- Support due diligence on acquisitions

- Analyze property performance

What it takes:

- 3-5 years in finance or real estate

- Strong Excel and financial modeling skills

- Bachelor’s in finance, accounting, or real estate

- CFA Level 1 candidate is a bonus

The path: This is your launching pad. Get good here, and you can move to Portfolio Manager, Asset Manager, or Acquisitions.

9. Real Estate Analyst ($72K Avg, Range $45K-$95K)

This is the entry point. Real estate analysts support the team with research, modeling, and administrative tasks.

Salary range (ZipRecruiter{rel=“nofollow”}, Nov 2025):

- Average: $72K

- Range: $45K-$95K (depending on location and company)

What they do:

- Market research (comp analysis, rent trends)

- Build basic financial models

- Prepare presentations for senior staff

- Coordinate data for acquisitions

What it takes:

- Bachelor’s degree in finance, real estate, or business

- Internship experience in real estate or finance

- Excel proficiency

- Willingness to grind

The reality: You’re doing the grunt work. But this is where you learn. Two years here, and you can level up to Senior Analyst or Asset Manager.

10. Property Manager ($67K Median)

Property managers run the day-to-day operations of individual buildings or portfolios.

Salary range (BLS, May 2024):

- Median: $67K

- Range: $43K-$98K

What they do:

- Tenant relations and leasing

- Maintenance and repairs

- Rent collection and budgets

- Coordinate with vendors

What it takes:

- 2-5 years in property management

- CPM (Certified Property Manager) certification

- Strong people skills

- Real estate license (in some states)

The truth: This is operational, not financial. But if you’re coming from real estate (not finance), it’s a solid entry point to the REIT world.

How to Break Into REIT Careers (From 3 Different Starting Points)

If You’re Coming From Finance

You’ve got a head start. REITs need people who can build models, analyze deals, and understand capital markets.

Your move:

- Target Real Estate Analyst or Senior Financial Analyst roles

- Highlight your modeling skills (DCF, IRR, cap rates)

- Learn Argus (the real estate modeling software)

- Network on LinkedIn with REIT finance teams

Timeline: 6-12 months to land your first role if you’re actively applying.

If You’re Coming From Real Estate

You understand properties, leasing, and operations. Now you need to learn the finance side.

Your move:

- Start as an Asset Manager or Property Manager at a REIT

- Take a financial modeling course (Wall Street Prep, BIWS)

- Get your CPM or pursue CFA Level 1

- Show you can bridge operations and finance

Timeline: 3-6 months to transition if you’re already in commercial real estate.

If You’re Starting Fresh

No finance degree. No real estate background. Can you still break in? Yes, but it takes hustle.

Your move:

- Get a bachelor’s in finance, real estate, or business

- Do internships (REITs hire summer analysts)

- Learn Excel and Argus on your own

- Network relentlessly (industry events, LinkedIn, informational interviews)

Timeline: 2-4 years (degree + internship + entry role).

The truth: REITs favor candidates with experience. But if you’re hungry and willing to learn, the door is open.

While you’re building toward a REIT career, here are some side hustles that can boost your income in the meantime.

Certifications That Actually Boost Your REIT Salary

Not all certifications are created equal. Some move the needle. Some don’t.

Worth It: CFA (Chartered Financial Analyst)

- Salary boost: 10-20% higher comp for senior roles

- Best for: Analysts, Portfolio Managers, CIOs, CFOs

- Time commitment: 3 exams, 900+ study hours

- The verdict: If you’re serious about finance, this is the gold standard.

Worth It (For Some Roles): CCIM (Certified Commercial Investment Member)

- Salary boost: Modest (5-10%), but opens doors

- Best for: Acquisitions, Asset Management

- Time commitment: 4 courses + exam

- The verdict: Great if you’re on the real estate side of the business.

Worth It (Tactical): Argus Training

- Salary boost: Indirect (makes you hireable)

- Best for: Analysts, Acquisitions

- Time commitment: 1-2 weeks

- The verdict: Not a certification, but a must-have skill. REITs use Argus for all deal modeling.

Skip (Unless Specific): MBA

- Salary boost: Depends on the school

- Best for: VP-level and above

- Time commitment: 2 years, $100K+ cost

- The verdict: Helpful for C-suite track, but not required. CFA is better ROI for most.

Consider (Niche): CPM (Certified Property Manager)

- Salary boost: Minimal at senior levels

- Best for: Property Managers, Asset Managers

- Time commitment: Courses + exam

- The verdict: Good for operations roles, less useful for finance-focused positions.

Top REITs Hiring Right Now (And What They’re Known For)

Not all REITs are created equal. Here are five consistently hiring - and paying well.

Prologis (Industrial/Logistics)

- What they do: Own 1 billion+ square feet of warehouses and distribution centers

- Why they’re hiring: E-commerce boom = demand for logistics space

- Roles: Acquisitions, Asset Management, Finance

Equinix (Data Center REITs)

- What they do: Own data centers powering cloud and internet infrastructure

- Why they’re hiring: AI and cloud growth

- Roles: Portfolio Management, Engineering, Operations

American Tower (Infrastructure REITs)

- What they do: Own cell towers and telecom infrastructure

- Why they’re hiring: 5G expansion

- Roles: Site Acquisition, Asset Management, Finance

Welltower (Healthcare REITs)

- What they do: Senior housing, medical office buildings, hospitals

- Why they’re hiring: Aging population

- Roles: Acquisitions, Asset Management, Operations

Simon Property Group (Retail REITs)

- What they do: Own malls and premium outlets

- Why they’re hiring: Post-pandemic retail recovery

- Roles: Leasing, Asset Management, Finance

Pro tip: Check their investor relations pages for quarterly earnings. Growing REITs = more hiring.

The Career Ladder: From $60K Analyst to $500K Executive

Here’s the realistic timeline if you start at the bottom and climb.

Years 0-2: Entry-Level Analyst ($45K-$72K)

- Learn the business

- Build models, run reports, support deals

- Get good at Excel and Argus

- Outcome: Promoted to Senior Analyst or jump to another REIT

Years 3-5: Senior Analyst / Junior Asset Manager ($85K-$120K)

- Lead projects

- Own sections of acquisitions or portfolio management

- Build relationships with brokers, lenders

- Outcome: Promotion to Portfolio Manager or Asset Manager

Years 6-9: Manager / Associate ($120K-$160K)

- Manage a portfolio or lead acquisitions

- Supervise junior analysts

- Present to senior leadership

- Outcome: Director or VP track

Years 10-14: Director / VP ($177K-$385K)

- Strategic decisions

- Manage teams

- Close major deals or oversee large portfolios

- Outcome: SVP or C-suite consideration

Years 15+: SVP / CXO / Executive ($360K-$500K+)

- Set strategy

- Report to board

- Represent company publicly

- Outcome: You’ve made it. Now keep performing.

The truth: Not everyone makes it to the top. But even hitting Director/VP level at $200K+ puts you in the top 5% of earners.

If building wealth is your goal, here’s the realistic roadmap to becoming a millionaire - and high-income careers like these are a big part of the equation.

Is a REIT Career Actually Worth It?

Let’s be honest. Every job has tradeoffs.

The upsides:

- High earning potential (6-figures by year 5-7)

- Equity comp that grows with the company

- Exposure to real estate without being a landlord

- Stable industry (people always need buildings)

The downsides:

- Long hours (especially in acquisitions)

- High pressure (you’re managing millions in capital)

- Cyclical industry (interest rates and recessions hit hard)

- Competitive (everyone wants these roles)

Work-life balance:

- Acquisitions: Brutal during deal cycles

- Asset Management / Portfolio Management: Reasonable (50-55 hours/week)

- Property Management: Depends (tenant emergencies don’t respect weekends)

- Finance / IR: Stressful during earnings, manageable otherwise

Job stability:

- REITs are generally stable, but they’re tied to real estate markets

- Rising interest rates = lower valuations = potential layoffs

- Diversified REITs (multiple property types) = more stability

The verdict: If you want high comp, like finance and real estate, and can handle pressure - this is one of the best career paths out there.

Frequently Asked Questions

Q: Do I need a finance degree to work at a REIT?

Not always. Many asset managers and property managers come from real estate backgrounds. But for analyst and VP roles, a finance, accounting, or real estate degree helps.

Q: Are REITs only in major cities?

Most REIT headquarters are in big metros (New York, San Francisco, Boston, Dallas). But they own properties nationwide, and some roles are remote or regional.

Q: How long does it take to reach $200K+ comp?

7-10 years if you start as an analyst and perform well. Faster if you jump from investment banking or private equity.

Q: Is REIT experience transferable to other industries?

Absolutely. Skills in financial modeling, acquisitions, and asset management translate to private equity, real estate development, and corporate finance.

Q: Do REITs hire people without CFA or MBA?

Yes. Experience and performance matter more than credentials. But certifications help you stand out.

Q: What’s the best way to network into a REIT?

LinkedIn (connect with analysts and VPs), industry conferences (Nareit, ULI), and informational interviews. Also, check job boards like REIT.com careers page.

Your Career, Your Call

You’ve seen the numbers. VP of Acquisitions pulling $259K. Portfolio managers at $160K. CFOs clearing $360K.

These aren’t lottery tickets. They’re real jobs at real companies managing real assets. And the path is clear: start as an analyst, build your skills, move up the ladder.

Will it be easy? No. Will it take years? Yes. Will every day be glamorous? Absolutely not.

But here’s what you get: high comp, equity upside, and a career that combines finance expertise with real estate strategy. You’re not stuck at a $75K ceiling anymore.

You’ve read the roadmap. You know which certifications matter. You know which REITs are hiring.

The question is: what are you going to do about it?

Start researching companies. Update your resume. Reach out to someone on LinkedIn who’s doing the job you want.

The best time to start was five years ago. The second best time is right now.

Get Weekly Wealth Tips

Real strategies delivered every week. No fluff, just actionable tips to build wealth.

No spam. Unsubscribe anytime.