Quiet Quitting Isn't the Answer—Financial Independence Is

- 05 Jan, 2026

In this article

- 1. Why Quiet Quitting Became a Thing (And Why It Doesn’t Work)

- 2. The Real Problem: You Have No Options

- 3. What Financial Independence Actually Looks Like

- 4. Build Income Streams So You Can Actually Quit

- 5. The 12-Month Plan to Replace Quiet Quitting with Real Options

- 6. What Happens When You Have Options

- 7. Stop Pretending and Start Building

You’ve done it. You’re showing up to meetings on mute with your camera off, doing the bare minimum to keep your paycheck coming, mentally checked out while physically still sitting at your desk.

They call it “quiet quitting.”

I call it being stuck.

Because here’s the thing: quiet quitting isn’t about setting boundaries or work-life balance. It’s about lacking the financial freedom to actually quit. You’re halfway out the door, but you can’t afford to leave.

That’s not a boundary. That’s a cage.

The real solution isn’t doing less at a job you hate. It’s building income streams so you have the option to walk away from jobs that drain you. Not someday. Not eventually. Within 12-24 months if you’re serious about it.

This is the guide to stop pretending you’re okay and start building the financial leverage to make real choices about your career.

Why Quiet Quitting Became a Thing (And Why It Doesn’t Work)

Quiet quitting blew up in 2022 as a response to hustle culture and post-pandemic burnout. The concept: do exactly what your job description says, nothing more. No late nights. No going above and beyond. Clock in, do your tasks, clock out.

Why people do it:

- Burnout from years of “rise and grind” culture

- Resentment over stagnant wages despite increased responsibilities

- Feeling undervalued at work

- Wanting to reclaim work-life balance

Why it doesn’t work:

- You’re still trapped in a job you don’t like

- Your income stays exactly the same (or shrinks)

- You’re still trading time for money at a fixed rate

- Promotions and raises dry up (because you’re visibly disengaged)

- You’re not building anything that moves you forward

Quiet quitting is a symptom, not a solution. The symptom is: “I hate this job but can’t afford to leave.” The solution isn’t pretending you don’t hate it. The solution is building enough income outside the job that leaving becomes possible.

The Real Problem: You Have No Options

Let’s be honest about what’s actually happening.

You’re not quiet quitting because you suddenly discovered boundaries. You’re quiet quitting because you’re frustrated, underpaid, and stuck. You know you should leave, but you can’t because:

- Your bills require this salary

- You have student loans or debt

- Your emergency fund is thin (or nonexistent)

- Your resume hasn’t been updated in 3 years

- You don’t have a side income stream

- Health insurance is tied to this job

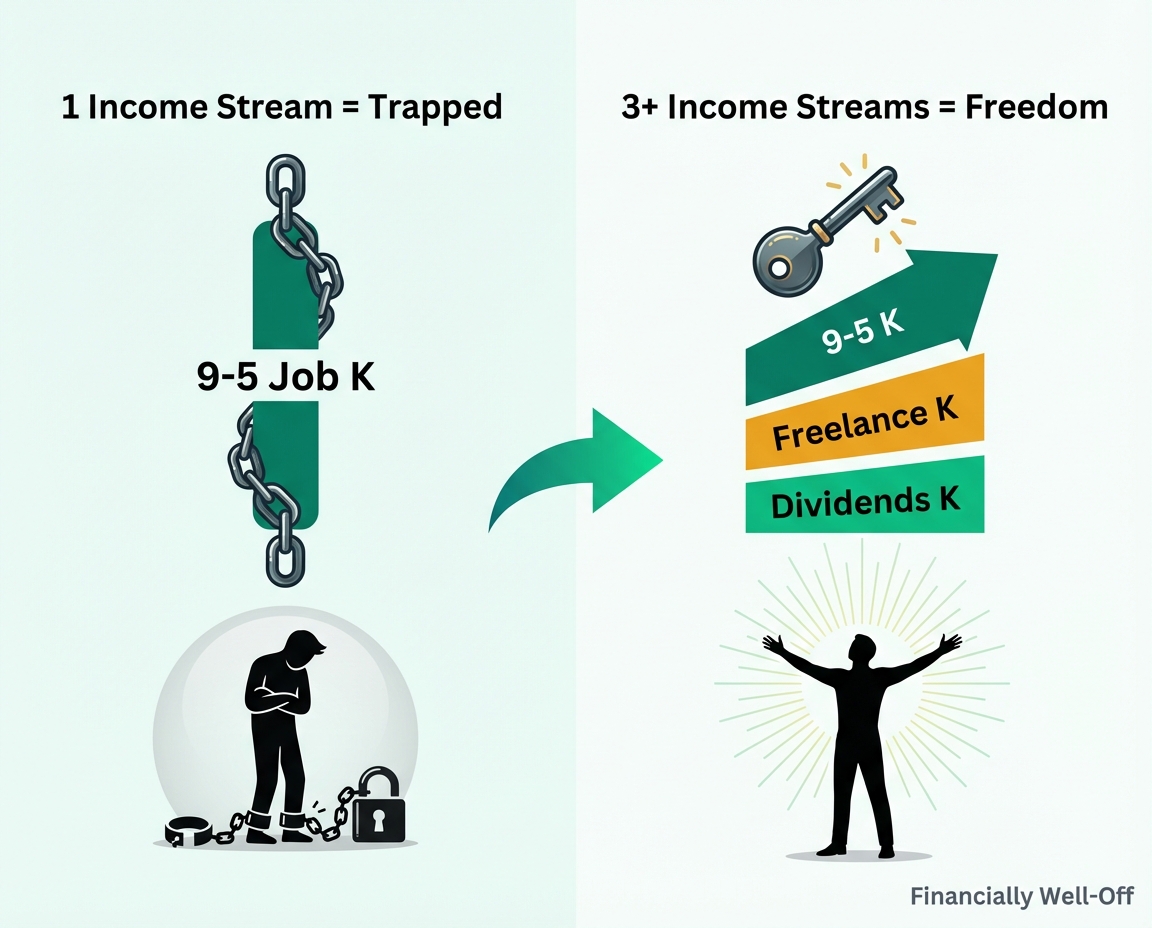

The brutal truth: When you have one income source, you have no leverage. Your employer knows you can’t leave easily. So your raises are small. Your promotions are slow. And your burnout is dismissed as “just part of the job.”

The problem isn’t that you need to work less. The problem is that you need more options.

What Financial Independence Actually Looks Like

Financial independence isn’t about retiring at 30 to sip margaritas on a beach (though if that’s your thing, go for it). It’s about having enough income streams and savings that work becomes a choice, not a requirement.

Financial independence means:

- You can walk away from a toxic job without panicking

- You can negotiate from a position of strength

- You can take time off to find the right job, not just any job

- You can downshift to a lower-stress role because your side income covers the gap

- You sleep better knowing you’re not one layoff away from disaster

The math:

- Save 6-12 months of living expenses (emergency fund)

- Build $2,000-4,000/month in side income

- Invest enough to generate passive income (dividends, real estate, index funds)

When you hit that point, everything changes. Suddenly your manager’s unreasonable demands aren’t life-or-death. They’re just annoying. You can set real boundaries because you’re not terrified of losing this job.

That’s power. That’s freedom. That’s what quiet quitting is trying to simulate without doing the work.

Want weekly strategies for building income outside your 9-5?

Join readers getting practical side hustle and investing tips every Friday. No spam, unsubscribe anytime.

Build Income Streams So You Can Actually Quit

The path out isn’t quiet quitting. It’s building multiple income streams so you can afford to leave.

Here’s how to do it:

Income Stream 1: Side Hustle That Scales

The fastest path to extra income is selling a skill or service. Not passive at first, but it pays faster than any other strategy.

High-ROI side hustles:

- Freelance writing ($2,000-4,000/month in 6-12 months)

- Consulting in your industry ($3,000-8,000/month if you have expertise)

- Content creation (YouTube, newsletters, courses—slower build but compounds)

- Digital products (templates, guides, tools—build once, sell repeatedly)

The 10-hour/week rule: If you dedicate 10 hours per week consistently, you can realistically build $2,000/month in side income within 6-9 months. That’s not a guarantee, but it’s a realistic timeline for people who show up consistently.

I started freelance writing at $0.08/word while working full-time. Six months later I was at $0.20/word. A year after that I was earning more from writing than my salary. The compounding is real.

Learn how to start freelance writing here

Income Stream 2: Invest for Passive Income

Side hustles are active income. Investing builds passive income. You need both.

Where to start:

- Max out 401(k) match (free money)

- Open a brokerage account (Vanguard, Fidelity, Schwab)

- Invest in index funds (VTI, VOO) or dividend stocks

- Automate contributions every paycheck

The math:

- Invest $500/month at 8% average annual return

- After 5 years: ~$37,000

- After 10 years: ~$92,000

- After 20 years: ~$295,000

That’s not overnight wealth. But it’s the difference between being stuck at a job you hate forever and having the option to walk away in 5-10 years.

Dividend investing is my personal favorite for this. You’re building an income stream that pays you quarterly whether you work or not. Even $100/month in dividends gives you options.

Dividend investing guide for beginners

Income Stream 3: Build a Real Emergency Fund

This isn’t sexy. But nothing gives you more power than knowing you can survive 6-12 months without a paycheck.

The formula:

- Calculate monthly expenses (rent, food, insurance, debt payments)

- Multiply by 6 (minimum) or 12 (ideal)

- Put it in a high-yield savings account (currently ~4-5% APY)

- Don’t touch it unless you’re actually unemployed

Example:

- Monthly expenses: $3,500

- 6-month fund: $21,000

- 12-month fund: $42,000

It sounds like a lot. But here’s the thing: once you have it, you can negotiate hard, walk away from bad jobs, and sleep at night. That’s worth more than any raise.

The 12-Month Plan to Replace Quiet Quitting with Real Options

Here’s exactly what to do over the next year:

Months 1-3: Set the Foundation

Money goals:

- Save $1,000 starter emergency fund

- Track every dollar you spend for 30 days (find the leaks)

- Cut 1-2 subscriptions you don’t use

- Set up automatic transfers to savings (start with $200/month if possible)

Income goals:

- Choose 1 side hustle to pursue

- Spend 5-10 hours/week building it

- Send your first pitches, launch your first product, or publish your first content

Months 4-6: Build Momentum

Money goals:

- Emergency fund hits $3,000-5,000

- Start investing $100-300/month in index funds or dividend stocks

- Increase savings rate by cutting one “big” expense (cheaper car, roommate, meal prep)

Income goals:

- Earn your first $500-1,000 from side hustle

- Get 2-3 repeat clients or consistent sales

- Reinvest profits into tools or skills that help you scale

Months 7-9: Scale Up

Money goals:

- Emergency fund hits $8,000-12,000

- Investing $300-500/month consistently

- Track net worth monthly (it’s motivating to see it grow)

Income goals:

- Side hustle earning $1,500-2,500/month

- Raise rates or expand offerings

- Build systems so it takes less time

Months 10-12: Decision Point

Money goals:

- Emergency fund fully funded (6+ months)

- Investments hitting $5,000-10,000

- Side income steady at $2,000-4,000/month

Income goals:

- Decide: Do I quit? Do I negotiate? Do I stay and keep building?

- If quitting: polish resume, line up freelance clients, give notice

- If staying: leverage your side income to negotiate remote work, fewer hours, or a raise

By month 12, you’re not quiet quitting anymore. You’re making decisions from a position of strength.

What Happens When You Have Options

I’m not going to pretend this is easy. Building income streams while working full-time is hard. It’s late nights. It’s sacrificing Netflix binges for client work. It’s learning skills you don’t have yet.

But here’s what changes when you do it:

Year 1: You stop dreading Mondays because you know you’re building an exit ramp.

Year 2: You start saying no to unreasonable requests at work because you’re no longer terrified of being fired.

Year 3: You’re making real choices: pivot careers, work part-time, go full-time freelance, or just enjoy the financial security while keeping your 9-5.

I went from $16,000 in debt on a $45,000 salary to a net worth over $200,000. It wasn’t because I’m special. It’s because I got obsessed with building income outside my job, investing every extra dollar, and refusing to stay stuck.

The difference between quiet quitting and financial independence is simple: one is pretending you have options. The other is building them.

Stop Pretending and Start Building

Quiet quitting feels like rebellion. It’s not. It’s resignation dressed up as self-care.

Real freedom is having enough money saved and enough income streams that you can walk into your boss’s office and say, “This isn’t working for me anymore,” without your heart racing because your rent depends on their answer.

You don’t need permission to start. You just need a plan.

Start here:

- Open a high-yield savings account and set up automatic transfers

- Pick one side hustle and spend 10 hours this week getting started

- Open a brokerage account and invest your first $100

One year from now, you’ll either have options or you’ll still be stuck. The only difference is what you do this week.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult a financial advisor for personalized guidance. Investing involves risk, including potential loss of principal.

Get Weekly Wealth Tips

Real strategies delivered every week. No fluff, just actionable tips to build wealth.

No spam. Unsubscribe anytime.